The AOF Real Estate

Insider Blog

Navigating Canada's Housing Market: Why Edmonton is Your Beacon of Stability

Why Investors Are Turning to Edmonton's Stable Market

The Canadian real estate landscape in mid-2025 is a tale of two markets: one grappling with significant challenges, and another shining as a beacon of stability and opportunity. While cautious stabilization hints at a national market finding its footing, deep-seated anxieties persist, primarily driven by affordability crises, mortgage payment shocks, and a chronic housing supply deficit. Yet, amidst this uncertainty, Alberta consistently demonstrates robust economic fundamentals, unparalleled affordability, and a thriving environment for investors.

Let's dive into the core issues affecting the broader Canadian market and then explore why Alberta stands out as a strategic choice.

The Landscape of Anxiety: Canada's Real Estate Under Pressure

Canada's housing market isn't just expensive; for many, it's becoming fundamentally unattainable. This pervasive anxiety stems from several critical factors:

1. The Persistent Affordability Crisis and Income-Price Disparity

The heart of Canada's housing dilemma lies in a widening gap between soaring home prices and stagnant incomes. Since 2015, the national average home price has skyrocketed by an astonishing 76%, while the median household income after tax has crept up by only 17% in the same period [1]. This isn't just about high prices; it's about a fundamental erosion of purchasing power, pushing homeownership out of reach for countless Canadians.

This disparity creates a market where even if sales figures seem balanced [2, 3], it often reflects a reality where many potential buyers are simply priced out, rather than a truly healthy equilibrium. The market has shifted to a higher tier, excluding a significant portion of the population.

2. The Mortgage Renewal "Squeeze" and Elevated Borrowing Costs

A major wave is crashing over Canadian homeowners: mortgage renewals. Approximately 23% of Canadians will renew their mortgages in 2025, with nearly half facing renewal within the next two years [4]. The anxiety is palpable, with 75% of those renewing this year dreading higher rates [4].

The culprits? Many homeowners secured fixed rates below 2% during the pandemic. Now, with the Bank of Canada's benchmark rate at 5% as of mid-2024, payment increases of 30% to 50% are common [1, 5]. This financial shockwave is forcing desperate measures: 60% plan to slash discretionary spending, 43% will cut travel, 36% will reduce savings, and a concerning 34% are even reducing spending on essentials like groceries [5]. Alarmingly, one in ten are considering downsizing or relocating to a more affordable region [5]. This isn't just a housing problem; it's an economic ripple effect impacting consumer spending and overall growth.

3. The Chronic Supply-Demand Imbalance and Population Growth

Canada desperately needs homes. The Canada Mortgage and Housing Corporation (CMHC) estimates a staggering 5.8 million new homes are required by 2030 to restore affordability [6]. Yet, only about 241,000 new units were completed in 2023, falling far short of annual requirements [1].

This chronic undersupply is intensified by Canada's unprecedented population boom. With 1.23 million new residents in 2023 and 951,517 in 2024 (largely due to immigration), demand is surging [7]. In 2023, Canada added 5.1 new residents for every housing unit started – the highest ratio since 1972, far exceeding the long-term average of 1.9 [7]. This stark mismatch means that without significant policy changes, housing affordability will remain a distant dream for many, continually pushing residents toward more accessible markets.

4. Fragile Market Confidence and Broader Economic Headwinds

While national home sales showed a slight rebound in May 2025 (+3.6% MoM), overall confidence remains fragile [2, 3]. Prices saw a modest decline of 1.2% MoM and 3.6% YoY in April 2025 [2]. Experts now point to "tariff uncertainty" and the potential for a "rough economic patch ahead" as new factors dampening buyer enthusiasm [2]. This broader economic and geopolitical volatility creates a complex outlook, suggesting that even interest rate relief may not fully alleviate market anxieties, making diversification into more stable regions even more appealing.

Alberta: A Beacon of Stability and Unmatched Opportunity

In sharp contrast to the national narrative, Alberta stands out as a compelling success story in the Canadian real estate market.

1. Economic Resilience and Strategic Diversification

Alberta's economy is no longer solely reliant on oil and gas. While still significant, the province has successfully diversified into burgeoning renewable energy and technology sectors [11, 12]. This strategic shift creates a more resilient and stable employment base, attracting a diverse pool of skilled professionals. With an employment growth rate surpassing Ontario's and a projected annual GDP growth of 3%, Alberta's strong economic fundamentals directly translate into robust housing demand and appreciation [10, 13, 14].

2. Unmatched Affordability and High Quality of Life

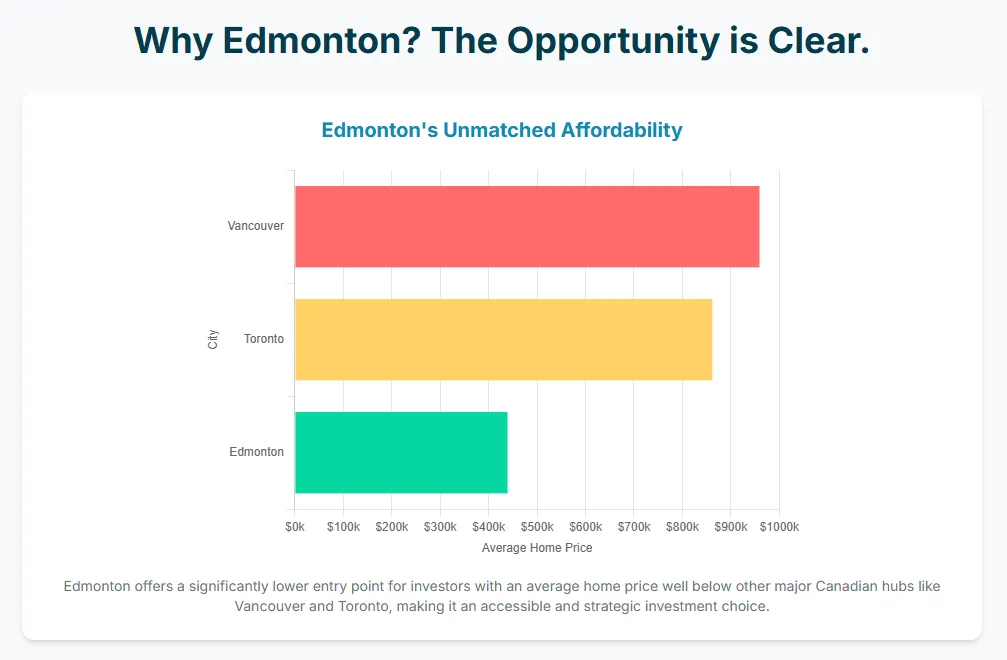

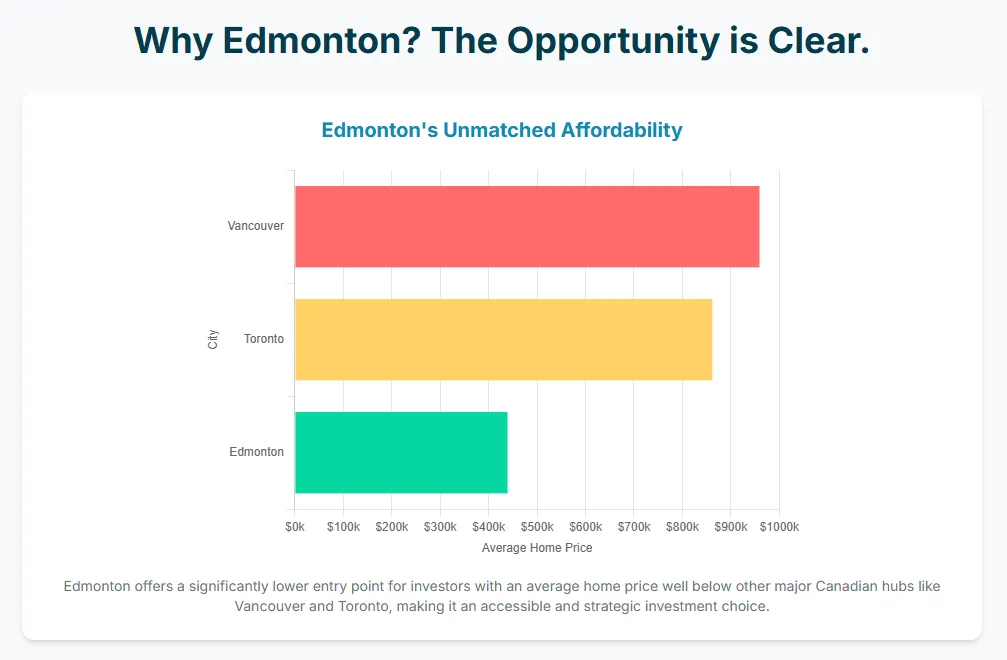

For both homebuyers and investors, Alberta offers unparalleled value. As of May 2025, Alberta's average home price was $528,261, dramatically lower than Ontario's ($861,719) and British Columbia's ($959,058) [15]. This means your capital stretches significantly further. Beyond housing, Albertans enjoy a lower overall cost of living, including cheaper utilities and transportation [13].

Coupled with stunning natural landscapes (Banff, Jasper), vibrant cities (Calgary, Edmonton), and low crime rates, Alberta offers an exceptional quality of life [11]. The province also boasts the lowest property tax rates in Canada, no provincial sales tax, and significantly lower closing costs compared to Ontario and BC, further enhancing its financial appeal [10, 11, 13]. This affordability acts as a major magnet, drawing residents from more expensive provinces and fueling sustained housing demand.

3. Robust Population Growth Driven by Interprovincial Migration

Alberta leads the nation in population growth, with a 4.4% increase in Q4 2024 and a 19.8% jump over the last decade [10, 12]. This growth is heavily driven by a continuous influx of residents, particularly from Ontario and British Columbia, who are seeking better affordability and opportunities [11, 12, 16]. While the pace of migration has moderated slightly in Q1 2025, the underlying trend of strong in-migration ensures consistent housing demand and supports long-term price stability [10, 17].

4. Healthy Market Dynamics and Attractive Investment Appeal

Alberta's market maintains healthy dynamics. While it has recently shifted from a seller's to a balanced market (SNLR of 59.7% in May 2025) [15], this reflects a healthy cooling rather than a downturn, preventing the unsustainable overheating seen elsewhere. Crucially, this balanced state is still robust, especially compared to Ontario's buyer's market (SNLR 34%) [15].

The multi-family real estate sector, in particular, is thriving, seen as a "safe haven" for investors during economic uncertainty [16]. Rents in Edmonton and Calgary have experienced substantial growth in the last 24 months – a long-awaited phenomenon [16]. Programs like CMHC's MLI Select, offering up to 95% loan-to-value, further fuel out-of-province and institutional investor interest, making large multi-family deals highly accessible [16].

5. Proactive Housing Development and Supportive Policy Environment

Alberta is experiencing record-breaking construction, with 46,632 new homes under construction in 2024, a 32% increase from 2023 [12]. Housing starts in Edmonton jumped 39% in 2024 [12]. While provincial policies have faced some criticism, municipal reforms in Calgary and Edmonton are actively improving zoning, increasing density, and implementing innovative solutions for faster permit approvals [20]. This proactive approach to boosting supply, coupled with strong economic fundamentals, underpins the market's stability and growth.

Conclusion and Strategic Outlook

The Canadian real estate market presents a clear dichotomy. While national anxieties driven by affordability, mortgage stress, and supply shortages will continue to challenge many households, Alberta stands apart. Its unique blend of accessibility, a diversifying and robust economy, sustained population growth, and a supportive local development environment positions it as a resilient market capable of weathering national uncertainties.

For homebuyers seeking a path to ownership and, crucially, for investors targeting stable cash flow and long-term appreciation, Alberta represents a strategic and compelling choice in the evolving Canadian real estate landscape. Now is the time to look west.

Contact us today for expert guidance: https://www.aofteam.com/contact

AOF Real Estate Team

Sources:

BMO

BMO Survey: Rising Recession Concerns Among Canadians Sidelining Prospective Homebuyers - May 5, 2025

Despite short-term concerns about the housing market, the BMO Real Financial Progress Index found over two thirds (70%) of Canadians feel confident in their ...

Bank of Canada

Financial Stability Report—2025 - Bank of Canada

While interest rates have come down significantly over the past year, previous increases in interest rates are still affecting mortgage renewals. A large share ...

Investment Executive

Homeowners expect mortgage payments to rise upon renewal in 2025: survey

Home News Research and Markets Homeowners expect mortgage payments to rise upon renewal in 2025: survey.

GlobeNewswire

4 in 5 Canadians say homeownership is now a luxury as new survey reveals impact of the housing crisis on quality of life - GlobeNewswire

4 in 5 Canadians say homeownership is now a luxury as new survey reveals impact of the housing crisis on quality of life.

Canada's homebuyers wait out trade war fallout - RBC

The chills the U.S. trade war has sent through participants in the housing market are getting frostier. March saw more homebuyers retreating to the sidelines ...

CTV News

Purchasing power: 85% of Quebecers say they experience financial anxiety - CTV News

High Confidence Response: 85%. Context: 85% of Quebecers say they experience financial anxiety. Download Our App.

CBC

Why Canada is on the cusp of a housing construction crisis | CBC News

Those statistics are worrying to many companies, especially paired with advocates' and government goals to make housing more affordable. To address the ...

Everything Mortgages

Canadian Mortgage Market and Homeownership: March 2025 Trends, Outlook & Update

First-time buyers in Canada face an uphill battle. Sky-high home prices and stricter mortgage qualifications have made it increasingly difficult for young ...

New Homes Alberta

Alberta Real Estate Market Trends 2025 – Forecasts

These numbers point to a strong and changing market in Alberta for 2025. It looks good for those thinking of investing or buying a home.

ImmigCanada

Immigration Fuels Alberta's Record-Breaking Population Growth - ImmigCanada

The combination of Alberta's Immigration strategies and strong economic policies positions the province as a key driver of Canada's future growth.

TD Stories - TD Bank

What's going on with Canada's housing supply? - TD Stories

With the population rising, it's very difficult to build enough new houses to keep up with demand.

New Homes Alberta

Alberta Housing Prices Analysis | Latest Market Data

Key Takeaways - Alberta's average home price increased 11.3% year-over-year. - Total residential sales reached 5,589 in November 2024.

[1] Source Report (provided immersive): "Canadian Real Estate Market Outlook: Navigating National Anxieties and Highlighting Alberta's Stability," I. Executive Summary, 2.1 Persistent Affordability Crisis.

[2] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.4 Fragile Market Confidence and Economic Headwinds, Table 1.

[3] Source Report (provided immersive): "Canadian Real Estate Market Outlook," II. The Landscape of Anxiety, 2.4 Fragile Market Confidence, Table 1 (May 2025 data).

[4] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.2 The Mortgage Renewal "Squeeze".

[5] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.2 The Mortgage Renewal "Squeeze" and Elevated Borrowing Costs.

[6] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.3 Supply-Demand Imbalance.

[7] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.3 Supply-Demand Imbalance and Population Growth Pressures.

[8] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta: A Beacon of Stability and Opportunity, 3.4 Healthy Market Dynamics.

[9] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.4 Fragile Market Confidence and Economic Headwinds; III. Alberta, 3.1 Economic Resilience.

[10] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; 3.3 Robust Population Growth; 3.4 Healthy Market Dynamics, Table 3.

[11] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; 3.2 Unmatched Affordability and Quality of Life; 3.3 Robust Population Growth.

[12] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; 3.3 Robust Population Growth; 3.5 Proactive Housing Development, Table 3.

[13] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; 3.2 Unmatched Affordability and Quality of Life.

[14] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; Table 3.

[15] Source Report (provided immersive): "Canadian Real Estate Market Outlook," Table 2: Provincial Real Estate Market Comparison (May 2025).

[16] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.3 Robust Population Growth; 3.4 Healthy Market Dynamics and Investment Appeal.

[17] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.3 Robust Population Growth and Interprovincial Migration.

[18] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.4 Healthy Market Dynamics.

[19] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.5 Proactive Housing Development.

[20] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.5 Proactive Housing Development and Supportive Policy Environment.

[21] Source Report (provided immersive): "Canadian Real Estate Market Outlook," Table 3 (Additional Context for Projected Housing Price Increase).

[22] Source Report (provided immersive): "Canadian Real Estate Market Outlook," Table 3 (Additional Context for Projected Housing Price Increase).

Navigating Canada's Housing Market: Why Edmonton is Your Beacon of Stability

Why Investors Are Turning to Edmonton's Stable Market

The Canadian real estate landscape in mid-2025 is a tale of two markets: one grappling with significant challenges, and another shining as a beacon of stability and opportunity. While cautious stabilization hints at a national market finding its footing, deep-seated anxieties persist, primarily driven by affordability crises, mortgage payment shocks, and a chronic housing supply deficit. Yet, amidst this uncertainty, Alberta consistently demonstrates robust economic fundamentals, unparalleled affordability, and a thriving environment for investors.

Let's dive into the core issues affecting the broader Canadian market and then explore why Alberta stands out as a strategic choice.

The Landscape of Anxiety: Canada's Real Estate Under Pressure

Canada's housing market isn't just expensive; for many, it's becoming fundamentally unattainable. This pervasive anxiety stems from several critical factors:

1. The Persistent Affordability Crisis and Income-Price Disparity

The heart of Canada's housing dilemma lies in a widening gap between soaring home prices and stagnant incomes. Since 2015, the national average home price has skyrocketed by an astonishing 76%, while the median household income after tax has crept up by only 17% in the same period [1]. This isn't just about high prices; it's about a fundamental erosion of purchasing power, pushing homeownership out of reach for countless Canadians.

This disparity creates a market where even if sales figures seem balanced [2, 3], it often reflects a reality where many potential buyers are simply priced out, rather than a truly healthy equilibrium. The market has shifted to a higher tier, excluding a significant portion of the population.

2. The Mortgage Renewal "Squeeze" and Elevated Borrowing Costs

A major wave is crashing over Canadian homeowners: mortgage renewals. Approximately 23% of Canadians will renew their mortgages in 2025, with nearly half facing renewal within the next two years [4]. The anxiety is palpable, with 75% of those renewing this year dreading higher rates [4].

The culprits? Many homeowners secured fixed rates below 2% during the pandemic. Now, with the Bank of Canada's benchmark rate at 5% as of mid-2024, payment increases of 30% to 50% are common [1, 5]. This financial shockwave is forcing desperate measures: 60% plan to slash discretionary spending, 43% will cut travel, 36% will reduce savings, and a concerning 34% are even reducing spending on essentials like groceries [5]. Alarmingly, one in ten are considering downsizing or relocating to a more affordable region [5]. This isn't just a housing problem; it's an economic ripple effect impacting consumer spending and overall growth.

3. The Chronic Supply-Demand Imbalance and Population Growth

Canada desperately needs homes. The Canada Mortgage and Housing Corporation (CMHC) estimates a staggering 5.8 million new homes are required by 2030 to restore affordability [6]. Yet, only about 241,000 new units were completed in 2023, falling far short of annual requirements [1].

This chronic undersupply is intensified by Canada's unprecedented population boom. With 1.23 million new residents in 2023 and 951,517 in 2024 (largely due to immigration), demand is surging [7]. In 2023, Canada added 5.1 new residents for every housing unit started – the highest ratio since 1972, far exceeding the long-term average of 1.9 [7]. This stark mismatch means that without significant policy changes, housing affordability will remain a distant dream for many, continually pushing residents toward more accessible markets.

4. Fragile Market Confidence and Broader Economic Headwinds

While national home sales showed a slight rebound in May 2025 (+3.6% MoM), overall confidence remains fragile [2, 3]. Prices saw a modest decline of 1.2% MoM and 3.6% YoY in April 2025 [2]. Experts now point to "tariff uncertainty" and the potential for a "rough economic patch ahead" as new factors dampening buyer enthusiasm [2]. This broader economic and geopolitical volatility creates a complex outlook, suggesting that even interest rate relief may not fully alleviate market anxieties, making diversification into more stable regions even more appealing.

Alberta: A Beacon of Stability and Unmatched Opportunity

In sharp contrast to the national narrative, Alberta stands out as a compelling success story in the Canadian real estate market.

1. Economic Resilience and Strategic Diversification

Alberta's economy is no longer solely reliant on oil and gas. While still significant, the province has successfully diversified into burgeoning renewable energy and technology sectors [11, 12]. This strategic shift creates a more resilient and stable employment base, attracting a diverse pool of skilled professionals. With an employment growth rate surpassing Ontario's and a projected annual GDP growth of 3%, Alberta's strong economic fundamentals directly translate into robust housing demand and appreciation [10, 13, 14].

2. Unmatched Affordability and High Quality of Life

For both homebuyers and investors, Alberta offers unparalleled value. As of May 2025, Alberta's average home price was $528,261, dramatically lower than Ontario's ($861,719) and British Columbia's ($959,058) [15]. This means your capital stretches significantly further. Beyond housing, Albertans enjoy a lower overall cost of living, including cheaper utilities and transportation [13].

Coupled with stunning natural landscapes (Banff, Jasper), vibrant cities (Calgary, Edmonton), and low crime rates, Alberta offers an exceptional quality of life [11]. The province also boasts the lowest property tax rates in Canada, no provincial sales tax, and significantly lower closing costs compared to Ontario and BC, further enhancing its financial appeal [10, 11, 13]. This affordability acts as a major magnet, drawing residents from more expensive provinces and fueling sustained housing demand.

3. Robust Population Growth Driven by Interprovincial Migration

Alberta leads the nation in population growth, with a 4.4% increase in Q4 2024 and a 19.8% jump over the last decade [10, 12]. This growth is heavily driven by a continuous influx of residents, particularly from Ontario and British Columbia, who are seeking better affordability and opportunities [11, 12, 16]. While the pace of migration has moderated slightly in Q1 2025, the underlying trend of strong in-migration ensures consistent housing demand and supports long-term price stability [10, 17].

4. Healthy Market Dynamics and Attractive Investment Appeal

Alberta's market maintains healthy dynamics. While it has recently shifted from a seller's to a balanced market (SNLR of 59.7% in May 2025) [15], this reflects a healthy cooling rather than a downturn, preventing the unsustainable overheating seen elsewhere. Crucially, this balanced state is still robust, especially compared to Ontario's buyer's market (SNLR 34%) [15].

The multi-family real estate sector, in particular, is thriving, seen as a "safe haven" for investors during economic uncertainty [16]. Rents in Edmonton and Calgary have experienced substantial growth in the last 24 months – a long-awaited phenomenon [16]. Programs like CMHC's MLI Select, offering up to 95% loan-to-value, further fuel out-of-province and institutional investor interest, making large multi-family deals highly accessible [16].

5. Proactive Housing Development and Supportive Policy Environment

Alberta is experiencing record-breaking construction, with 46,632 new homes under construction in 2024, a 32% increase from 2023 [12]. Housing starts in Edmonton jumped 39% in 2024 [12]. While provincial policies have faced some criticism, municipal reforms in Calgary and Edmonton are actively improving zoning, increasing density, and implementing innovative solutions for faster permit approvals [20]. This proactive approach to boosting supply, coupled with strong economic fundamentals, underpins the market's stability and growth.

Conclusion and Strategic Outlook

The Canadian real estate market presents a clear dichotomy. While national anxieties driven by affordability, mortgage stress, and supply shortages will continue to challenge many households, Alberta stands apart. Its unique blend of accessibility, a diversifying and robust economy, sustained population growth, and a supportive local development environment positions it as a resilient market capable of weathering national uncertainties.

For homebuyers seeking a path to ownership and, crucially, for investors targeting stable cash flow and long-term appreciation, Alberta represents a strategic and compelling choice in the evolving Canadian real estate landscape. Now is the time to look west.

Contact us today for expert guidance: https://www.aofteam.com/contact

AOF Real Estate Team

Sources:

BMO

BMO Survey: Rising Recession Concerns Among Canadians Sidelining Prospective Homebuyers - May 5, 2025

Despite short-term concerns about the housing market, the BMO Real Financial Progress Index found over two thirds (70%) of Canadians feel confident in their ...

Bank of Canada

Financial Stability Report—2025 - Bank of Canada

While interest rates have come down significantly over the past year, previous increases in interest rates are still affecting mortgage renewals. A large share ...

Investment Executive

Homeowners expect mortgage payments to rise upon renewal in 2025: survey

Home News Research and Markets Homeowners expect mortgage payments to rise upon renewal in 2025: survey.

GlobeNewswire

4 in 5 Canadians say homeownership is now a luxury as new survey reveals impact of the housing crisis on quality of life - GlobeNewswire

4 in 5 Canadians say homeownership is now a luxury as new survey reveals impact of the housing crisis on quality of life.

Canada's homebuyers wait out trade war fallout - RBC

The chills the U.S. trade war has sent through participants in the housing market are getting frostier. March saw more homebuyers retreating to the sidelines ...

CTV News

Purchasing power: 85% of Quebecers say they experience financial anxiety - CTV News

High Confidence Response: 85%. Context: 85% of Quebecers say they experience financial anxiety. Download Our App.

CBC

Why Canada is on the cusp of a housing construction crisis | CBC News

Those statistics are worrying to many companies, especially paired with advocates' and government goals to make housing more affordable. To address the ...

Everything Mortgages

Canadian Mortgage Market and Homeownership: March 2025 Trends, Outlook & Update

First-time buyers in Canada face an uphill battle. Sky-high home prices and stricter mortgage qualifications have made it increasingly difficult for young ...

New Homes Alberta

Alberta Real Estate Market Trends 2025 – Forecasts

These numbers point to a strong and changing market in Alberta for 2025. It looks good for those thinking of investing or buying a home.

ImmigCanada

Immigration Fuels Alberta's Record-Breaking Population Growth - ImmigCanada

The combination of Alberta's Immigration strategies and strong economic policies positions the province as a key driver of Canada's future growth.

TD Stories - TD Bank

What's going on with Canada's housing supply? - TD Stories

With the population rising, it's very difficult to build enough new houses to keep up with demand.

New Homes Alberta

Alberta Housing Prices Analysis | Latest Market Data

Key Takeaways - Alberta's average home price increased 11.3% year-over-year. - Total residential sales reached 5,589 in November 2024.

[1] Source Report (provided immersive): "Canadian Real Estate Market Outlook: Navigating National Anxieties and Highlighting Alberta's Stability," I. Executive Summary, 2.1 Persistent Affordability Crisis.

[2] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.4 Fragile Market Confidence and Economic Headwinds, Table 1.

[3] Source Report (provided immersive): "Canadian Real Estate Market Outlook," II. The Landscape of Anxiety, 2.4 Fragile Market Confidence, Table 1 (May 2025 data).

[4] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.2 The Mortgage Renewal "Squeeze".

[5] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.2 The Mortgage Renewal "Squeeze" and Elevated Borrowing Costs.

[6] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.3 Supply-Demand Imbalance.

[7] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.3 Supply-Demand Imbalance and Population Growth Pressures.

[8] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta: A Beacon of Stability and Opportunity, 3.4 Healthy Market Dynamics.

[9] Source Report (provided immersive): "Canadian Real Estate Market Outlook," 2.4 Fragile Market Confidence and Economic Headwinds; III. Alberta, 3.1 Economic Resilience.

[10] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; 3.3 Robust Population Growth; 3.4 Healthy Market Dynamics, Table 3.

[11] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; 3.2 Unmatched Affordability and Quality of Life; 3.3 Robust Population Growth.

[12] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; 3.3 Robust Population Growth; 3.5 Proactive Housing Development, Table 3.

[13] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; 3.2 Unmatched Affordability and Quality of Life.

[14] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.1 Economic Resilience; Table 3.

[15] Source Report (provided immersive): "Canadian Real Estate Market Outlook," Table 2: Provincial Real Estate Market Comparison (May 2025).

[16] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.3 Robust Population Growth; 3.4 Healthy Market Dynamics and Investment Appeal.

[17] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.3 Robust Population Growth and Interprovincial Migration.

[18] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.4 Healthy Market Dynamics.

[19] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.5 Proactive Housing Development.

[20] Source Report (provided immersive): "Canadian Real Estate Market Outlook," III. Alberta, 3.5 Proactive Housing Development and Supportive Policy Environment.

[21] Source Report (provided immersive): "Canadian Real Estate Market Outlook," Table 3 (Additional Context for Projected Housing Price Increase).

[22] Source Report (provided immersive): "Canadian Real Estate Market Outlook," Table 3 (Additional Context for Projected Housing Price Increase).

Professional Realty Group

102, 3221 Parsons Road NW

Edmonton, AB

Tel: 780-439-9818

Email: [email protected]

https://www.profdessionalgroup.ca

Professional Realty Group

102, 3224 Parsons Road NW

Edmonton, AB

Tel: 587-906-4022

Email: [email protected]

https://www.professionalgroup.ca

JOIN OUR EMAIL LIST FOR EXCLUSIVE REAL ESTATE OPPORTUNITIES